For The First Time, Viva Will Allow Investors To Own A Highly Profitable And Supported Mortgage Frequency Shares (FMS).

In the modern world, where digital communication is rapidly becoming as important as live interaction and where people are increasingly wary of centralized power, the natural direction for technology and finance to take is towards a crypto-economy based on blockchain technology, whose main pillars are transparency and decentralization. However, blockchain in its current form is not universally applicable. Lack of access to transactions, payments, credit and insurance has been the greatest barrier holding back residents of third world countries from advancing in the global economy. A large portion of the world’s population does not have access to financial systems that are financially inclusive which perpetuates economic inequality. With the introduction of Viva which is Financial Inclusion has help the economy, individual, films, businesses in the sense that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way. Before i proceed lets take a look at the video below....

VIVA

The Viva Network is a decentralized ecosystem that connects mortgage borrowers with global investors within a border-less, blockchain-secured cloud platform. Viva technology uses Ethereum smart contracts to underwrite and securitize private home loans into Fractionalized Mortgage Shares (FMS) which can easily be bought and sold on the Viva FMS Exchange (a Secondary Market Exchange) application.

Viva’s function as an investment and savings platform accessible with just a mobile phone means all users of Viva will have access to credit financing, a savings and investment account, and standard blockchain-backed secure transaction services - regardless of what country they live in.

VISION

Revolutionize the antiquated mortgage lending industry by cutting out the middlemen and decentralizing the process, thereby applying a fundamentally more accessible and transparent approach to financing.

MISSION

To disrupt the mortgage industry by allowing home buyers and sellers to set the terms themselves.

PROBLEMS

High interest rates for buyers, low interest rates for investors

Getting a mortgage is challenging and frustrating, and for many creditworthy individuals around the world - is often impossible. Furthermore, the profit model behind mortgage loans and Mortgage Backed Securities is one of the most lucrative business models in existence. Despite this, banking corporations around the world consistently exploit consumers with price gouging, collusion and even interest rate manipulation. This centralised authority is irresponsible, and we believe these profits belong to the consumers - the homebuyers and investors - instead of the middlemen (the banks).

SOLUTION

Low interest rates for buyers, high interest rates for investors

Viva is a hybrid blockchain protocol that introduces a brand new option for consumers around the world to finance their homes - the free market. Viva technology uses Ethereum smart contracts to underwrite and securitize private home loans into Fractionalized Mortgage Shares (FMS) which can easily be bought and sold on the Viva FMS Exchange.

VIVA TOKEN

VIVA Tokens (VIVA) are Ethereum blockchain based ERC20 tokens, designed to provide utility within The Viva Network Platform’s exclusive applications.

The Viva Network is a decentralized ecosystem that connects mortgage borrowers with global investors within a border-less, blockchain-secured cloud platform. Viva technology uses Ethereum smart contracts to underwrite and securitize private home loans into Fractionalized Mortgage Shares (FMS) which can easily be bought and sold on the Viva FMS Exchange (a Secondary Market Exchange) application.

Viva’s function as an investment and savings platform accessible with just a mobile phone means all users of Viva will have access to credit financing, a savings and investment account, and standard blockchain-backed secure transaction services - regardless of what country they live in.

VISION

Revolutionize the antiquated mortgage lending industry by cutting out the middlemen and decentralizing the process, thereby applying a fundamentally more accessible and transparent approach to financing.

MISSION

To disrupt the mortgage industry by allowing home buyers and sellers to set the terms themselves.

PROBLEMS

High interest rates for buyers, low interest rates for investors

Getting a mortgage is challenging and frustrating, and for many creditworthy individuals around the world - is often impossible. Furthermore, the profit model behind mortgage loans and Mortgage Backed Securities is one of the most lucrative business models in existence. Despite this, banking corporations around the world consistently exploit consumers with price gouging, collusion and even interest rate manipulation. This centralised authority is irresponsible, and we believe these profits belong to the consumers - the homebuyers and investors - instead of the middlemen (the banks).

SOLUTION

Low interest rates for buyers, high interest rates for investors

Viva is a hybrid blockchain protocol that introduces a brand new option for consumers around the world to finance their homes - the free market. Viva technology uses Ethereum smart contracts to underwrite and securitize private home loans into Fractionalized Mortgage Shares (FMS) which can easily be bought and sold on the Viva FMS Exchange.

VIVA TOKEN

VIVA Tokens (VIVA) are Ethereum blockchain based ERC20 tokens, designed to provide utility within The Viva Network Platform’s exclusive applications.

FUNCTION OF VIVA TOKEN

Network Currency

Cash flows from fixed-income FMS

Mortgage Crowdfunding

Data Analysis

Real Value 2.0 – Home Valuation Application (“RV2”).

Ability to use the ‘Real Value 1.0’ Home Valuation Software

Fractionalized Mortgage Shares

VIVA DEVELOPMENT PLAN

PHASE ONE

Continued development of proprietary decentralized applications like the Real Value 2.0 Home Valuation App, using advanced algorithms and machine learning integrations:-

Creation of tangible and intangible value through operations

Expanding marketing and promotional campaigns using large scale partnerships and acquisitions for the adoption of the Viva Network on a global scale.

Phase One will be focused on creating a valuable working model in our test market, before launching

to additional markets in Phase Two.

PHASE TWO

In 2019 we intend to expand the operation to the first five countries that provide the most opportunistic risk/reward profile for FMS investors.

Phase Two will focus on expanding our working model to countries that can most easily navigate the various hurdles required with The Viva Network’s operation.

PHASE THREE

By 2022 we intend for The Viva Network’s applications to be self-evolving and completely decentralized, with all three primary systems working together.

Phase Three will seek to expand operations to all countries that don’t have particular regulatory or other operational hurdles which prohibit the operation (For example: Countries which don’t have clearly defined mortgage foreclosure procedures).

PHASE FOUR

The long term development goal is to make The Viva Network a global household name, completely decentralizing the mortgage process and eliminating the need for home-buyers to seek financing from traditional banks.

VIVA PLATFORM

Viva DApp: This encloses layer of abstraction between the user-facing Viva applications (below) and the Ethereum blockchain. The Viva DApp encodes the set of static rules/terms agreed to by parties involved. Viva DApp is a low level backing system that other traditional webapps on the Viva Platform interact with and through (via web3.js or similar).

Viva RV2 Home Valuation: This web-based DApp is concerned with home valuations and the collection of data supporting further refinement of our home valuation models. It will primarily allow VIVA token holders to input a range of characteristics through a simple wizard-style form and obtain a home valuation from our proprietary pricing algorithms. The secondary function of this DApp will be to collect market data through incentives and convenient tools (e.g. mobile apps that prospective homebuyers can use to keep track of the houses they view will feed into our pricing models eventually).

Viva Credit Scoring: This DApp essentially serves as the Viva Network Platform user account system. In order to achieve a largely self-regulating and decentralized mortgage marketplace, it is essential that investors can accurately assess the risk of their investments. This allows a legitimate user to grow their credit history and use services globally with much more convenience.

Viva FMS Exchange (Investor Marketplace) : This web-based DApp serves as a trading platform for investors to participate in the mortgage listings flowing into the blockchain. This is a system allowing registered investors to buy and sell stakes in the mortgages after browsing through mortgage listings and funds. It will provide basic trading platform functions such as listing alerts, automated screening, viewing portfolio and transaction histories, etc.

Proprietary Algorithms: Viva intends to apply proprietary machine learning techniques to a diverse set of collected data to enable assistive automation and predictions for many aspects of the Viva Network Platform, such as:Home valuation (multiple RV2 valuation perspectives/models), FMS risk assessment (default risk modelling, prepayment risk modelling, fraud detection, etc.), Mortgage classification and fund creation of fractionalized mortgage shares, Customized recommendations based on investor characteristics and goals, Credit scoring system (A quantitative V-Score credit assessment).

TOKEN DETAILS

Token: VIVA

Platform: Ethereum

Standard: ERC20

Quantity: 3,000,000,000 VIVA

Price: 35,714 VIVA = 1 ETH

Payment: ETH

Hard cap: 3,000,000,000 VIVA

Network Currency

Cash flows from fixed-income FMS

Mortgage Crowdfunding

Data Analysis

Real Value 2.0 – Home Valuation Application (“RV2”).

Ability to use the ‘Real Value 1.0’ Home Valuation Software

Fractionalized Mortgage Shares

VIVA DEVELOPMENT PLAN

PHASE ONE

Continued development of proprietary decentralized applications like the Real Value 2.0 Home Valuation App, using advanced algorithms and machine learning integrations:-

Creation of tangible and intangible value through operations

Expanding marketing and promotional campaigns using large scale partnerships and acquisitions for the adoption of the Viva Network on a global scale.

Phase One will be focused on creating a valuable working model in our test market, before launching

to additional markets in Phase Two.

PHASE TWO

In 2019 we intend to expand the operation to the first five countries that provide the most opportunistic risk/reward profile for FMS investors.

Phase Two will focus on expanding our working model to countries that can most easily navigate the various hurdles required with The Viva Network’s operation.

PHASE THREE

By 2022 we intend for The Viva Network’s applications to be self-evolving and completely decentralized, with all three primary systems working together.

Phase Three will seek to expand operations to all countries that don’t have particular regulatory or other operational hurdles which prohibit the operation (For example: Countries which don’t have clearly defined mortgage foreclosure procedures).

PHASE FOUR

The long term development goal is to make The Viva Network a global household name, completely decentralizing the mortgage process and eliminating the need for home-buyers to seek financing from traditional banks.

VIVA PLATFORM

Viva DApp: This encloses layer of abstraction between the user-facing Viva applications (below) and the Ethereum blockchain. The Viva DApp encodes the set of static rules/terms agreed to by parties involved. Viva DApp is a low level backing system that other traditional webapps on the Viva Platform interact with and through (via web3.js or similar).

Viva RV2 Home Valuation: This web-based DApp is concerned with home valuations and the collection of data supporting further refinement of our home valuation models. It will primarily allow VIVA token holders to input a range of characteristics through a simple wizard-style form and obtain a home valuation from our proprietary pricing algorithms. The secondary function of this DApp will be to collect market data through incentives and convenient tools (e.g. mobile apps that prospective homebuyers can use to keep track of the houses they view will feed into our pricing models eventually).

Viva Credit Scoring: This DApp essentially serves as the Viva Network Platform user account system. In order to achieve a largely self-regulating and decentralized mortgage marketplace, it is essential that investors can accurately assess the risk of their investments. This allows a legitimate user to grow their credit history and use services globally with much more convenience.

Viva FMS Exchange (Investor Marketplace) : This web-based DApp serves as a trading platform for investors to participate in the mortgage listings flowing into the blockchain. This is a system allowing registered investors to buy and sell stakes in the mortgages after browsing through mortgage listings and funds. It will provide basic trading platform functions such as listing alerts, automated screening, viewing portfolio and transaction histories, etc.

Proprietary Algorithms: Viva intends to apply proprietary machine learning techniques to a diverse set of collected data to enable assistive automation and predictions for many aspects of the Viva Network Platform, such as:Home valuation (multiple RV2 valuation perspectives/models), FMS risk assessment (default risk modelling, prepayment risk modelling, fraud detection, etc.), Mortgage classification and fund creation of fractionalized mortgage shares, Customized recommendations based on investor characteristics and goals, Credit scoring system (A quantitative V-Score credit assessment).

TOKEN DETAILS

Token: VIVA

Platform: Ethereum

Standard: ERC20

Quantity: 3,000,000,000 VIVA

Price: 35,714 VIVA = 1 ETH

Payment: ETH

Hard cap: 3,000,000,000 VIVA

https://youtu.be/QBRfmPqSxwA

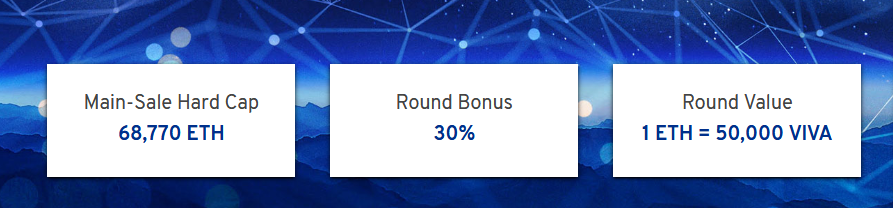

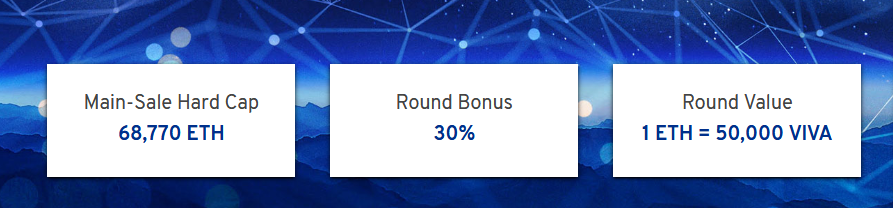

PRE-ICO

Beginning: 31.03.2018

Completion: 14.04.2018

Bonus: 35%

ICO

Beginning: 14.04.2018

Completion: 14.06.2018

bonus system:

Up to 11,200 ETH - 25%

Up to 33,070 ETH - 15%

Up to 68,700 ETH- No

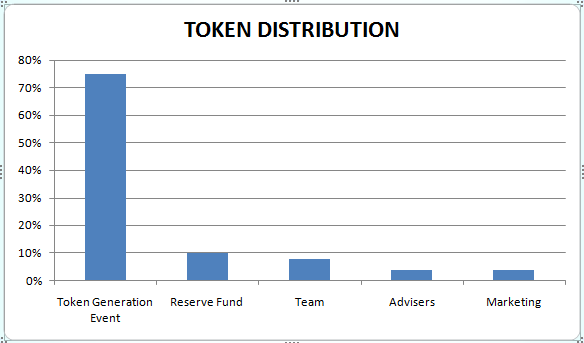

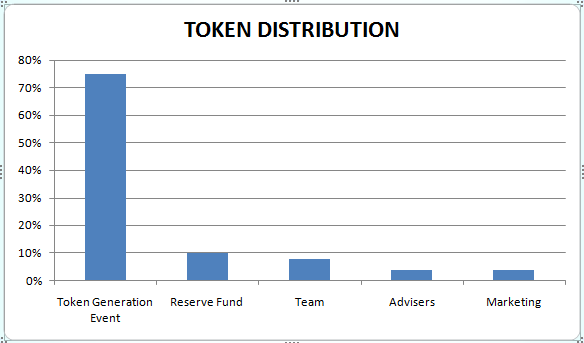

TOKEN DISTRIBUTION

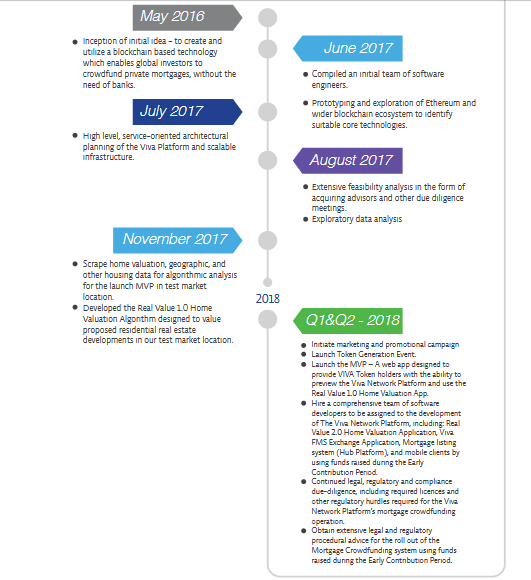

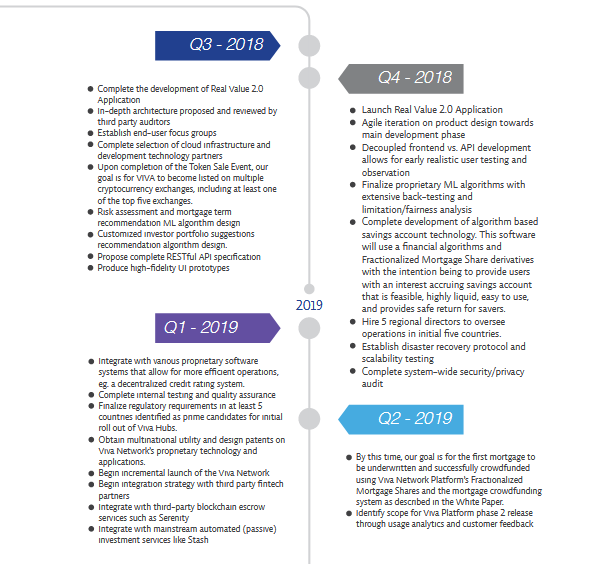

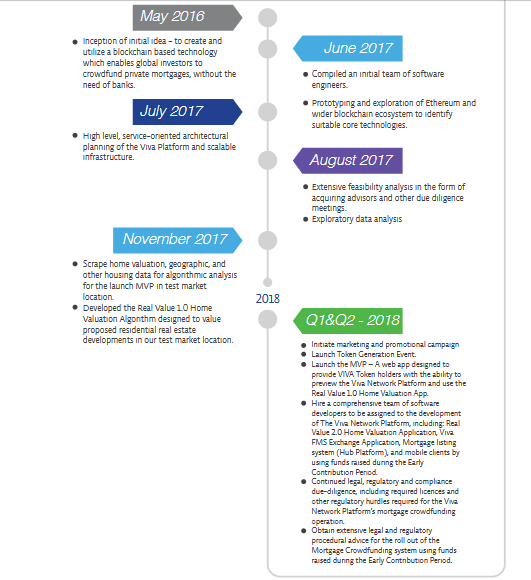

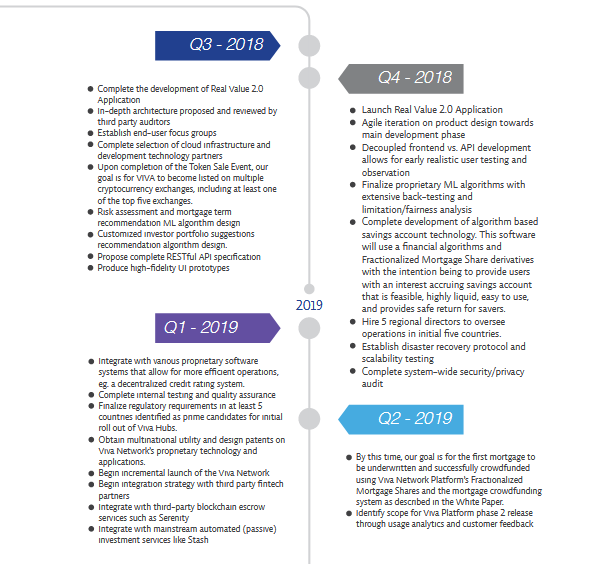

ROADMAP

May 2016 - The beginning of the original idea.

June 2017 - Study of the ecosystem of chain links for the determination of relevant basic technologies.

July 2017 - Planning for the high-quality service-oriented architecture of the Viva platform.

August 2017 - Data analysis of geological exploration and feasibility study.

November 2017 - Development of the algorithm for estimating value 1.0.

Q1 & Q2 - 2018 - Token Generation events start and MVP development. Start a large-scale marketing campaign.

Q3 - 2018 - Development of Real Value 2.0 application. Obtain legal and regulatory licenses.

Q4 - 2018 - launches the Real Value 2.0 application. Completion of exclusive ML-algorithms.

Q1 - 2019 - to begin the gradual launch of the Viva network platform.

Q2 - 2019 - Launch the Viva Network platform and a successful first mortgage loan with a Viva mortgage loan system.

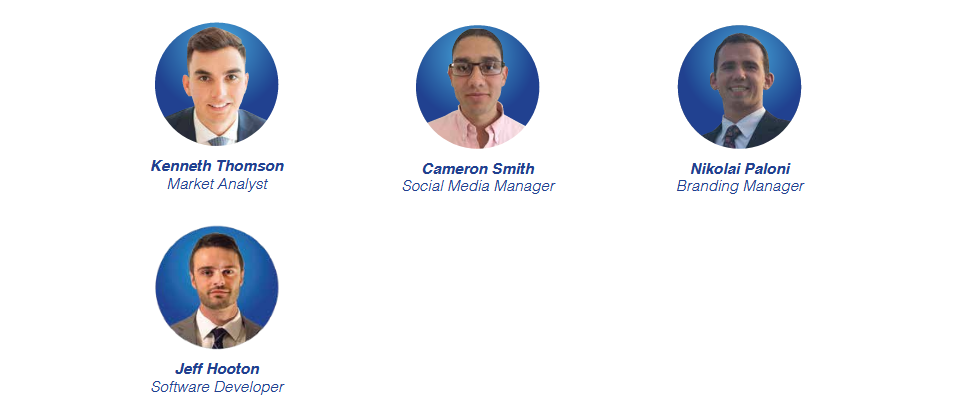

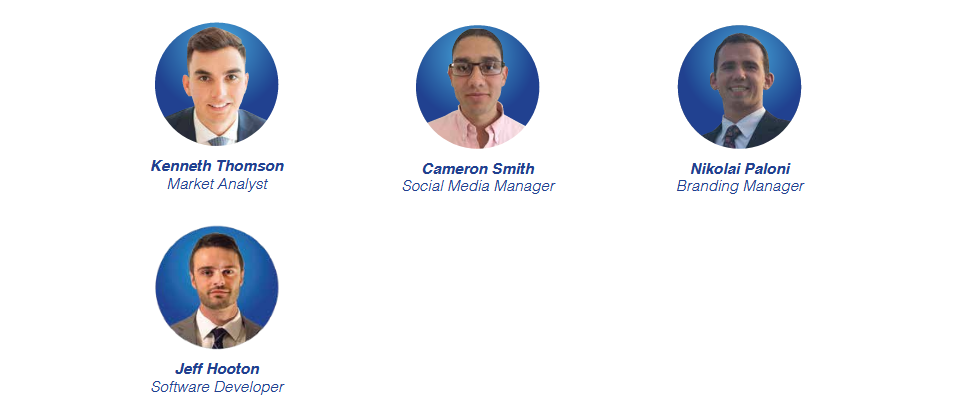

THE VIVA TEAM

For more information, please visit:

Web site: http://www.vivanetwork.org/

Whitepaper: http://www.vivanetwork.org/pdf/whitepaper.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=3430485.0

Twitter: https://twitter.com/TheVivaNetwork

Facebook: https://www.facebook.com/VivaNetworkOfficial/

Medium: https://medium.com/@VivaNetwork

Telegram: http://t.me/Wearethevivanetwork

Bounty Thread: https://bitcointalk.org/index.php?topic=3602784

ROADMAP

May 2016 - The beginning of the original idea.

June 2017 - Study of the ecosystem of chain links for the determination of relevant basic technologies.

July 2017 - Planning for the high-quality service-oriented architecture of the Viva platform.

August 2017 - Data analysis of geological exploration and feasibility study.

November 2017 - Development of the algorithm for estimating value 1.0.

Q1 & Q2 - 2018 - Token Generation events start and MVP development. Start a large-scale marketing campaign.

Q3 - 2018 - Development of Real Value 2.0 application. Obtain legal and regulatory licenses.

Q4 - 2018 - launches the Real Value 2.0 application. Completion of exclusive ML-algorithms.

Q1 - 2019 - to begin the gradual launch of the Viva network platform.

Q2 - 2019 - Launch the Viva Network platform and a successful first mortgage loan with a Viva mortgage loan system.

THE VIVA TEAM

For more information, please visit:

Web site: http://www.vivanetwork.org/

Whitepaper: http://www.vivanetwork.org/pdf/whitepaper.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=3430485.0

Twitter: https://twitter.com/TheVivaNetwork

Facebook: https://www.facebook.com/VivaNetworkOfficial/

Medium: https://medium.com/@VivaNetwork

Telegram: http://t.me/Wearethevivanetwork

Bounty Thread: https://bitcointalk.org/index.php?topic=3602784

Author: Al Wahhaab

My Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=1977595

My ETH: 0x870d66F0756bCB956359Ca0120e026e9A640217A

Komentar

Posting Komentar